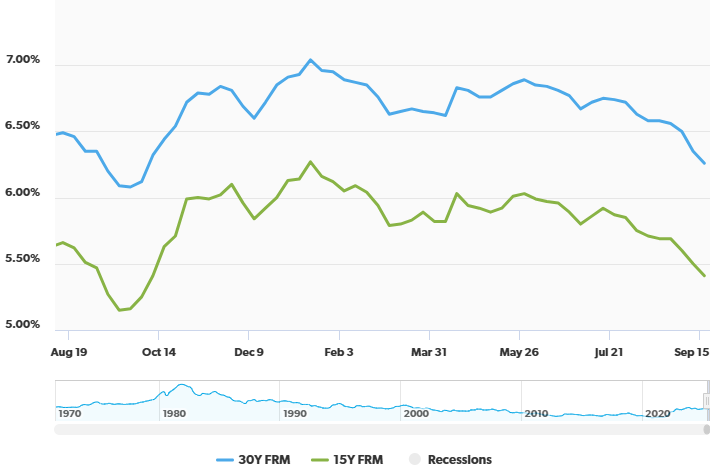

On Wednesday, the Federal Reserve dropped its benchmark 'federal funds rate' by 0.25% and announced plans for two more rate cuts before the year is out. So, how did the mortgage market react? Well, initially, it didn't much. As is often the case, the Fed had long since telegraphed its intentions to drop rates so much of the market had already factored this in. Mortgage interest rates have been falling (slowly, but surely) since the end of July in expectation of these rate cuts. The average rate on a 30-year fixed rate mortgage has dropped from a high in the 6.8% range this summer down to around 6.25% as I write this post. By the way, if you're looking for the best way to track rates, I recommend checking out Freddie Mac's Primary Mortgage Market Survey (PMMS).

Only time will tell whether rates will fall as low as 6% before the end of the year. According to the Freddie Mac's PMMS, mortgage rates haven't been that low since late September last year (2024). And they were only around for a couple of weeks before ticking back up into the mid 6% range.

Say it with me: The Fed funds rate does not control the mortgage market.

Of course, the Fed is only one part of the story when it comes to mortgage rates. And there's actually not really a direct connection either. The federal funds rate is actually the rate at which banks lend their reserves to each other overnight. When banks don't have to spend as much to lend each other money short-term they often also reduce rates on consumer facing short-term loans like credit card rates, auto financing and even Adjustable Rate Mortgages (ARMs).

But, 30-year fixed mortgages are very long-term fixed loans and aren't as directly affected as short-term financing often is. Instead, mortgage rates are more closely connected to the yield on 10-year U.S. treasury notes (the interest the U.S. government pays to those who buy its debt). The bond market (as the market for treasuries is called) attempts to price in expectations of future economic growth and inflation in order to ensure yields remain reasonable for investors.

This dynamic leads to situations like what happened the last time rates were in the low 6% range for the 30-year fixed rate mortgage. Last September, the Fed cut the federal funds rate by twice as much (0.5%). You may think this explains why rates briefly bottomed out around 6% last September, right? Well, it doesn't. Those lows were actually just before the Fed cut rates. After that rate cut, rates steadily rose to around 6.84% in mid-November. Why? The U.S. bond market (specifically yields on 10-year treasury notes) went steadily higher based on relatively strong job growth, persistent inflation and other fiscal policies and more interest rates followed.

So, what's happening in the bond market now? Well, in the wake of the Wednesday cuts, the 10-year treasury yield hit a 2-week high which could indicate that mortgage rates are unlikely to fall and more likely to stabilize or even rise in the short-term.

Is history repeating itself? September 2024 all over again?

This latest drop may represent a similar low for the year as we saw in September 2024. I don't have a crystal ball and there are a lot of factors at play (especially whether or not the U.S. enters a recession in the near future), but if you're looking to buy a home in northern Colorado in the next several months and need some help from a mortgage lender to do it, you could probably do worse than betting on now as a good time to lock in a rate on a new home. And you could definitely do worse than hiring a buyer's agent who can guarantee you save money on your next purchase.