In real estate parlance (the parlance of our times), the concept of a "buyer’s market" or "seller’s market" is pretty common. Each of these are so-named for which side has more leverage in negotiations based solely on the prevailing market factors in the area. A seller’s market is one in which the typical seller has more leverage than a buyer due to factors like low supply (inventory) paired with comparatively high buyer demand. Anyone who has taken Econ 101 can tell you this means upward price pressure, which often shows up as multiple-offer situations and sales prices above the original list price.

You can probably guess, then, what a buyer's market is like. Yep, it's essentially the opposite. A glut of supply and inventory of homes results in properties sitting on the market for longer with no or little buyer interest. Any seller that wants to sell their home in a timely manner will therefore be forced to resort to significant price reductions or other concessions to attract a buyer. The 'balanced' market is, of course, what lies in between these two extremes.

The 'Big 4' Market Indicators

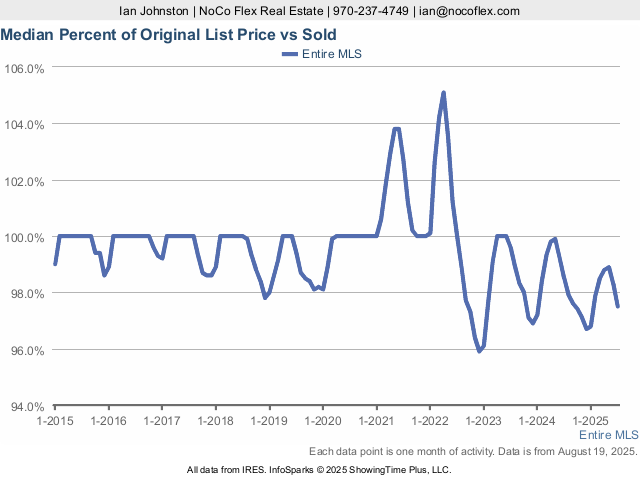

After over a decade in a seller's market, it is now becoming clear that northern Colorado has moved squarely into balanced market territory. To demonstrate this, let's take a look at what I like to call the 'Big 4' market indicators to see how our current market stacks up. My 'Big 4' includes well known metrics like the median home price and the median days to offer (DTO) (how long it takes the typical home to accept an offer). It also includes the most common measure of inventory -- months of supply -- which tells you how long the housing inventory in an area would last if new listings stopped today. Lastly, I include the 'original list-price-to-sales-price percentage' which (despite being a bit of a mouthful) tells us what percent of the average seller’s original list price they actually get at closing. 100% or more means the average home is selling at or above asking; under 100% means buyers typically get a discount. Here are the figures for each of these indicators for the last month we have data (July 2025) for the northern Colorado MLS (IRES):

|

|

|

|

|---|

Now, the criteria for what constitutes a seller's market vs. a balanced market or buyer's market for each of these metrics isn't universally agreed upon, but most brokers and economists will say that when it takes the average home more than 30 days to go under contract, you're out of seller's market territory and things are certainly moving more slowly for sellers which tells you something about supply and demand. Similarly, for months of supply anything above 4 months is considered to be the low-end of inventory for a more balanced market.

Saying Goodbye to the Seller's Market and Welcoming Balance

So, now that we're officially within the realm of balance, how has that impacted prices? Well, you can see from the list price-to-sales price percentage above that sellers are getting less than they are asking on average. That roughly 2.5% discount equates to about a $14,000 savings for a buyer off the typical home.

When we look at the median sales price over time, prices have more-or-less plateaued (flattened out) since interest rates rose above 6% around three years ago. That said, if inventory remains above 4 months of supply I wouldn't be surprised to see prices start ticking downward a bit. It certainly seems that price corrections are the rule rather than the exception these days with many listings. In Fort Collins, for example, we’ve recently seen significantly more listings with price drops than those that have closed or gone under contract. From 2015 to 2023, price drops were so rare that only a single July (July 2019) saw an average list-to-sales price ratio below 100%--over most of the last decade it's been the rule that buyers in northern Colorado have had to pay full price or more, especially in the busy summer season. Now, for each of the last three years, sellers have been stuck giving discounts in order to sell--even in July. And this past July saw the biggest discounts of the last decade. These are the kinds of price drops that used to only be necessary to attract buyers in the much slower winter season.

The Reason for the Shift: Not Much of a Mystery

There's one major market indicator I've mostly avoided until now, and it’s the factor most economists consider responsible for the market shift: mortgage interest rates. In fall 2022 they ticked above 6% for the first time since 2008 and have hovered in the 6% range (even flirting with 7%) ever since. Of course, most buyers can't afford a home that costs hundreds of thousands without a little help from a lender. And the difference between a 2-4% and 6%+ interest rate can mean hundreds of dollars more on a monthly payment. For many buyers, that made the payment unaffordable at prevailing prices; for others, it made buying less appealing--even if technically affordable. That drop in demand contributed to the increase in supply, combined with downward price pressure fighting against inflation and other cost increases which gave us the plateau in prices we see today.

Good Time to Buy? Bad Time to Sell?

So, what's the upshot? If you were waiting to buy, should you get off the fence? If you were thinking of selling, should you think twice? Well, it's not quite that simple. Yes, generally, things have moved more in the direction of favoring buyers in many markets. Still, prices remain stubborn and we've only just begun to see signs that inventory has reached the level that could lead to more downward pressure on prices. If you’re a buyer who can afford the higher interest rates and were put off by the highly competitive market of most of the last decade (prior to fall 2022), this market could actually be quite appealing. Many buyers are finding they can be more picky about what they want in a home. And when they do find one they like, they often find that they have leverage to offer less than the asking price and/or demand price concessions or repairs if the inspection turns up issues. In many cases, the amount of seller concessions buyers can negotiate allows them to buy down their mortgage rate and offset a lot of those increased interest costs (that average $14,000 discount seen last month? If applied as a closing cost credit that could significantly offset higher interest costs). And borrowers aren't wedded to their original interest rate--they can refinance down the road if rates drop.

Where does that leave sellers? Well, this is definitely not as good a market as the one we've known here in northern Colorado for most of the last decade. Still, that doesn't mean it's terrible. We're talking about a balanced market here, remember? Not a true buyer's market, which is the ultimate fear of a home seller. And, so long as you didn't buy your home in the last 3-4 years or so, you still probably have enough equity to sell and make a profit on the sale. It just may take a bit longer and you may not be able to get as much as you would like in the end. Of course, if you need to sell and get a mortgage on a replacement property, you may find yourself in the unenviable position of swapping a mortgage with a 3-4% interest rate (or even lower) for one with a 6%+ interest rate and the increased monthly payment that represents. This is often referred as the 'lock-in effect'. With this in mind, perhaps it's not too surprising too learn that many sellers have chosen to stay on the sidelines. Enough, in fact, that the number of Americans who move in a given year is at an all-time low, which has broader consequences for the economy.

So, as we bid goodbye (for now) to the seller's market we knew for several years, the overall takeaway is that the market is better for buyers (assuming you can afford to buy in the first place) and a bit tougher for sellers. But, the crucial point here is that quality advice and service matters even more today than it has in the past. Otherwise, it's easy to miss opportunities or to make mistakes that could cost valuable time or money or even keep a sale or purchase from happening altogether.